Richmond Real Estate Market

The speculation and vacancy tax is an annual tax paid by

owners of residential properties in designated taxable regions of BC. It only

applies to properties classified as residential that are also in designated

taxable regions.

Registered owners of residential property in a designated

taxable region must complete a declaration EACH YEAR to declare their residency

status and how their property has been used. If a property has more than one

owner, each owner must declare separately even if the other owner is spouse or

relative.

Declaration timeline is:

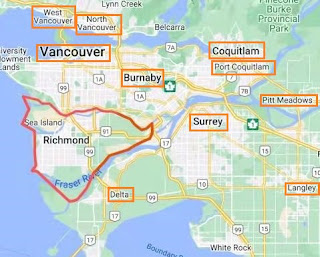

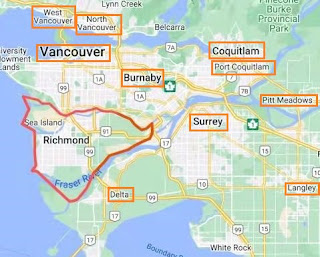

The designated taxable regions include Capital Regional

District, Metro Vancouver Regional District, City of Abbotsford, District of

Mission, City of Chilliwack, City of Kelowna, City of West Kelowna, City of

Nanaimo, District of Lantzville.

There are some exclusions

Also, there are

some exemptions for individuals even if the properties are in taxable regions:

Speculation

& vacancy tax is different with Vancouver’s empty homes tax.

|

Speculation

& Vacancy Tax |

Vancouver’s

Empty Homes Tax |

|

The government of BC |

City of Vancouver |

|

Tax rate is 0.5% of the previous year’s

assessed property tax for Canadian citizens, 2% for foreign owners and satellite

families. |

1% of the property’s assessed taxable

value. |

Comments

Post a Comment