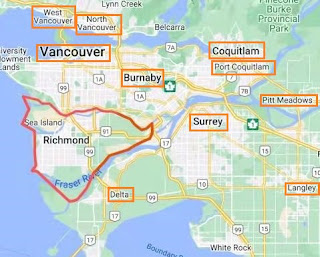

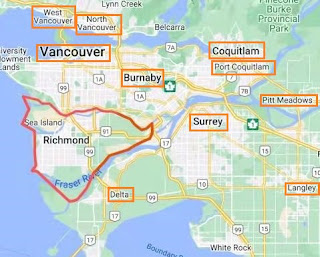

Richmond Real Estate Market

People who own a property in BC receive a BC assessment notice in January each year. It provides an assessed value based on the market value of the property as of July 1 of the PREVIOUS year. In determining the assessed value, the property’s unique characteristics are considered, including:

If you believe information on your notice is incorrect, first thing you do is to contact local BC Assessment office and discuss your concerns. The assessment may be corrected without an independent review. However, if your concerns are not satisfied, you file a complaint to the Property Assessment Review Panel (PARP). The deadline is January 31 of each year. PARP hearings take place between February and March 15 each year.

The next level of appeal is to the Property Assessment Appeal Board (PAAB). You can appeal to the PAAB only after filing a complaint to the PARP. The deadline to file an appeal with the PAAB is April 30 each year.

For specific details on the appeal process, view the Appeal Guide, at https://info.bcassessment.ca/Services-products/appeals/Appeal-Guide

Comments

Post a Comment