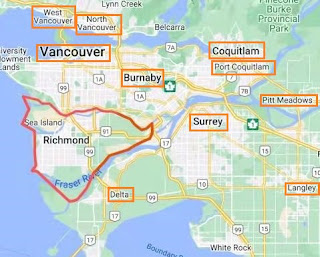

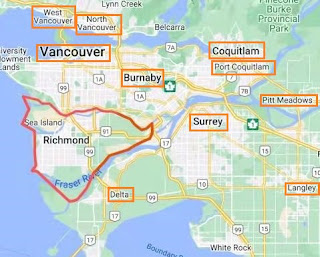

Richmond Real Estate Market

A lot of people get a mortgage when they buy a

property, especially when mortgage rates are so low. What options does

a borrower have to pay the mortgage and which option benefits a borrower more? Generally,

more frequent payments create substantial interest savings and reduce the loan’s

amortization period. We discuss three options here: monthly payments, biweekly

payments and accelerated biweekly payments. Biweekly payments are

popular since they match most people’s earning frequency. What is the difference

between biweekly payments and accelerated biweekly payments? Biweekly payments

are constant payments that are paid every two weeks. Accelerated biweekly

payments are constant payments that are equal to ½ of the regular monthly

payment and paid every two weeks. We use an example to illustrate three

options.

A mortgage loan of $200,000, interest rate 2.39%,

calculated semi-annually, not in advance. Amortization period of 30 year, and a

term of 5 year.

|

Option |

Each Payment |

Principal Paid over Term |

Interest Paid over Term |

Balance end of Term |

|

Constant

Monthly Payments |

$777.63 |

$24,266.08 |

$22,391.72 |

$175,733.92 |

|

Constant

Biweekly Payments |

$358.72 |

$24,266.79 |

$22,366.81 |

$175,733.21 |

|

Accelerated

Biweekly Payments |

$388.82 |

$28,419.79 |

$22,126.81 |

$171,580.21 |

Accelerating payments is a faster way to pay off a mortgage and to reduce interest costs. The borrower actually makes the equivalent

of one extra monthly payment per year. The

borrower would pay $4,153.00 more by end of a 5 year term in this case.

Comments

Post a Comment