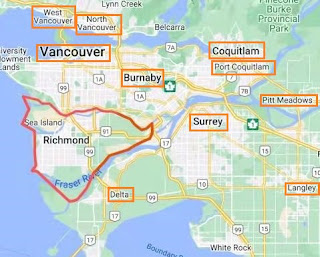

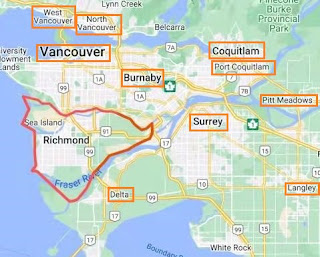

Richmond Real Estate Market

A friend of mine told me her friend’s situation with a

property one day. I think it may be an interesting topic to some people. To make thing easier, let’s name a couple "A" and "B". "A" was married to "B" who was much

older than her. "B" has a daughter. "B" would like "A" to still live in his house

after he dies, but pass the ownership to his daughter.

Regarding the situation, "B" should make a will which create a life estate in favour of "A", with the remainder of B’s house going to his daughter. After "B" passes away, his daughter would appear on the certificate of title as owner, A’s life estate would appear as a charge.

What is a “life estate”? A life estate is an estate in land that lasts for the lifetime of the holder, who is called a life tenant. A life tenant is entitled to all the rights of use and possession of the land, and received any revenues. But a life tenant doesn’t have a right to sell the property.

What is a “ remainder”? A remainder is

the person that is entitled to the property once the life tenant dies. In this

case, "A" will be the life tenant and B’s daughter will be the remainder.

The life tenant is liable for all yearly operational

expenses, including electricity, water, heat and taxes, and for the payment of

interest if there is any outstanding mortgage. The remainder is liable to pay

the principal on any outstanding mortgage and any insurance premiums.

If you need more information regarding ownership, please click here or contact me at awang@macrealty.com

Very well done.

ReplyDeleteThank you!

Delete